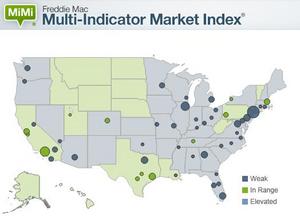

MCLEAN, VA--(Marketwired - Feb 25, 2015) - Freddie Mac (OTCQB: FMCC) today released its newly updated Multi-Indicator Market Index® (MiMi®)showing the U.S. housing market continuing to stabilize at the national level for the fourth consecutive month. Thirty-eight of the 50 states, plus the District of Columbia, and 40 of the 50 metros, are now showing an improving three month trend. Three additional metros entered their benchmarked stable ranges of housing activity including Buffalo, Boston and Nashville.

News Facts:

- The national MiMi value stands at 74.9, indicating a weak housing market overall but showing a slight improvement (+0.37%) from November to December and a positive 3-month trend of (+1.09%). On a year-over-year basis, the U.S. housing market has improved (+4.41%). The nation's all-time MiMi high of 121.7 was April 2006; its low was 57.2 in October 2010, when the housing market was at its weakest. Since that time, the housing market has made a 31 percent rebound.

- Sixteen of the 50 states plus the District of Columbia have MiMi values in a stable range, with the District of Columbia (97.6), North Dakota (97.2), Montana (91.1), Hawaii (89.9) and Wyoming (89.1) ranking in the top five.

- Eleven of the 50 metro areas have MiMi values in a stable range, with Los Angeles (86.4), Austin (86.3), San Jose (83.9), Houston (83.3), and Pittsburgh (83.3) ranking in the top five.

- The most improving states month-over-month were Delaware (+1.87%), Michigan (+1.28%), North Carolina (+1.18%), Oregon (+1.18%) and Texas (+0.85%) On a year-over-year basis, the most improving states were Nevada (+19.87%), Colorado (+11.42%), Rhode Island (10.52%), Illinois (+10.14%), and Ohio (+9.27%)

- The most improving metro areas month-over-month were Detroit (+1.40%), Tampa (+1.28), Kansas City (+1.13%), Louisville (+1.12%), and Charlotte (1.04%). On a year-over-year basis the most improving metro areas were Las Vegas (+19.76%), Denver (+12.14%), Chicago (+10.93%), Providence (+10.35%) and Columbus (+9.36%).

- In December, 38 of the 50 states and 40 of the 50 metros were showing an improving three month trend. The same time last year, 47 states plus the District of Columbia, and 47 of the top 50 metro areas were showing an improving three month trend.

Quote attributable to Freddie Mac Deputy Chief Economist Len Kiefer:

"Housing markets are getting back on track. The national MiMi improved for the fourth consecutive month. Nearly 80 percent of the state and metro housing markets MiMi tracks are improving or in their stable range of activity. We've even seen the MiMi purchase application indicator increase 0.07 percent on a year-over-year basis. Low mortgage rates and moderating house price growth are helping to keep payment-to-income ratios favorable for the typical family in most of the country. In fact, Los Angeles is the only metro market with an elevated MiMi payment-to-income indicator whereas most other markets remain quite affordable. And of course, labor markets are generally improving.

"As we mentioned last month, we're keeping an eye on markets with deep ties to energy. We've seen some deterioration on a month-over-month basis in some of these energy markets. For example, Louisiana has seen its state employment situation deteriorate over the last several months. A declining employment indicator has caused its MiMi score to move from 86.7 in April down to 80.2."

The 2015 MiMi release calendar is available online. The February release of MiMi includes revisions to the Purchase Applications indicator based on the latest The Home Mortgage Disclosure Act (HMDA) data.

MiMi monitors and measures the stability of the nation's housing market, as well as the housing markets of all 50 states, the District of Columbia, and the top 50 metro markets. MiMi combines proprietary Freddie Mac data with current local market data to assess where each single-family housing market is relative to its own long-term stable range by looking at home purchase applications, payment-to-income ratios (changes in home purchasing power based on house prices, mortgage rates and household income), proportion of on-time mortgage payments in each market, and the local employment picture. The four indicators are combined to create a composite MiMi value for each market. Monthly, MiMi uses this data to show, at a glance, where each market stands relative to its own stable range of housing activity. MiMi also indicates how each market is trending, whether it is moving closer to, or further away from, its stable range. A market can fall outside its stable range by being too weak to generate enough demand for a well-balanced housing market or by overheating to an unsustainable level of activity.

For more detail on MiMi see the FAQs. The most current version can be found at FreddieMac.com/mimi.

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for approximately one in four home borrowers and is one of the largest sources of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.