MCLEAN, VA--(Marketwired - Sep 17, 2015) - Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates largely unchanged ahead of the Federal Open Market Committee's vote on an interest-rate increase for the first time in more than nine years.

MCLEAN, VA--(Marketwired - Sep 17, 2015) - Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates largely unchanged ahead of the Federal Open Market Committee's vote on an interest-rate increase for the first time in more than nine years.

News Facts

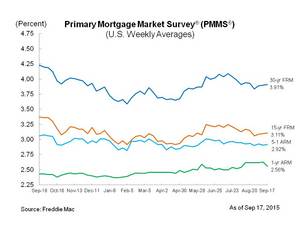

- 30-year fixed-rate mortgage (FRM) averaged 3.91 percent with an average 0.6 point for the week ending September 17, 2015, up from last week when it averaged 3.90 percent. A year ago at this time, the 30-year FRM averaged 4.23 percent.

- 15-year FRM this week averaged 3.11 percent with an average 0.6 point, up from last week when it averaged 3.10 percent. A year ago at this time, the 15-year FRM averaged 3.37 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.92 percent this week with an average 0.5 point, up from last week when it averaged 2.91 percent. A year ago, the 5-year ARM averaged 3.06 percent.

- 1-year Treasury-indexed ARM averaged 2.56 percent this week with an average 0.2 point, down from last week when it averaged 2.63 percent. At this time last year, the 1-year ARM averaged 2.43 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for the Regional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quote

Attributed to Sean Becketti, chief economist, Freddie Mac.

"The Treasury market was relatively quiet this week, and as a result the 30-year mortgage rate barely budged. Inflation fell shy of expectations in August, up 0.2 percent over the past year, but core consumer prices increased 1.8 percent year-over-year. Low mortgage rates help to support housing markets, which continue to bring good news. The National Association of Home Builders' HMI came in above expectations at 62, which is a ten year high."

"Even if the Fed decides to raise short-term interest rates, we don't expect a significant impact on the housing market. We're still on track for the best year of home sales since 2007. And in contrast to two years ago, when mortgage rates spiked in response to the Taper Talk, the economy is in much better shape and markets have been expecting the Fed to act for months. While our outlook incorporates a moderate increase in mortgage rates over the next 18 months, rates are likely to remain low by historical standards and should not be a determining factor for most Americans looking to purchase a home."

"Freddie Mac is keenly aware though that any rate increase will have a larger impact on low-to-moderate income families looking to finance a home purchase. We introduced our low down payment program, Home Possible Advantage, specifically to address the challenges faced by these households."

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is one of the largest sources of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.