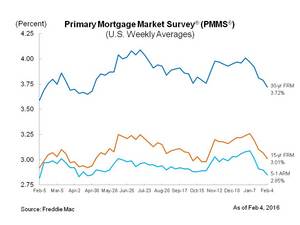

MCLEAN, VA--(Marketwired - Feb 4, 2016) - Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates moving lower for the fifth consecutive week amid ongoing market volatility. The average 30-year fixed is at its lowest point since the week of April 30, 2015 when it averaged 3.68 percent.

MCLEAN, VA--(Marketwired - Feb 4, 2016) - Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates moving lower for the fifth consecutive week amid ongoing market volatility. The average 30-year fixed is at its lowest point since the week of April 30, 2015 when it averaged 3.68 percent.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.72 percent with an average 0.6 point for the week ending February 4, 2016, down from last week when it averaged 3.79 percent. A year ago at this time, the 30-year FRM averaged 3.59 percent.

- 15-year FRM this week averaged 3.01 percent with an average 0.5 point, down from 3.07 percent last week. A year ago at this time, the 15-year FRM averaged 2.92 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.85 percent this week with an average 0.4 point, down from last week when it averaged 2.90 percent. A year ago, the 5-year ARM averaged 2.82 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quote

Attributed to Sean Becketti, chief economist, Freddie Mac.

"Market volatility -- and the associated flight to quality -- continued unabated this week. The yield on the 10-year Treasury dropped another 15 basis points, and the 30-year mortgage rate fell 7 basis points as well, to 3.72 percent. Both the Treasury yield and the mortgage rate now are in the neighborhood of early-2015 lows. These declines are not what the market anticipated when the Fed raised the Federal funds rate in December. For now, though, sub-4-percent mortgage rates are providing a longer-than-expected opportunity for mortgage borrowers to refinance."

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is the largest source of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.