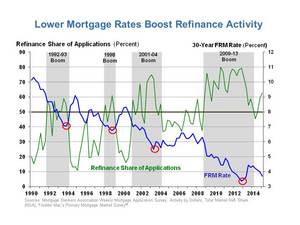

MCLEAN, VA--(Marketwired - Apr 30, 2015) - Freddie Mac (OTCQB: FMCC) today released the results of its quarterly refinance analysis for the first quarter of this year, showing that borrowers took advantage of better than expected mortgage rates to lower their monthly mortgage payment and shorten their loan term as refinance activity accounted for 63 percent of all single-family originations. Approximately 27 percent of borrowers increased their loan amount when refinancing, either by cashing out equity or consolidating loans, versus 29 percent from last quarter, 17 percent from the same time last year and well below the peak of 89 percent in 2006.

MCLEAN, VA--(Marketwired - Apr 30, 2015) - Freddie Mac (OTCQB: FMCC) today released the results of its quarterly refinance analysis for the first quarter of this year, showing that borrowers took advantage of better than expected mortgage rates to lower their monthly mortgage payment and shorten their loan term as refinance activity accounted for 63 percent of all single-family originations. Approximately 27 percent of borrowers increased their loan amount when refinancing, either by cashing out equity or consolidating loans, versus 29 percent from last quarter, 17 percent from the same time last year and well below the peak of 89 percent in 2006.

News Facts

- The net dollars of home equity converted to cash as part of a refinance remained low compared to historical volumes. In the first quarter, an estimated $7.7 billion in net home equity was cashed out during a refinance of conventional prime-credit home mortgages, down from the revised $7.6 billion the previous quarter in 2014 dollars. The peak in cash-out refinance volume was $84 billion during the second quarter of 2006, with an annual volume of $320.6 billion.

- Of borrowers who refinanced during the first quarter of 2015, 34 percent shortened their loan term, down slightly from the previous quarter. Of eligible borrowers who used the Home Affordable Refinance Program (HARP), 36 percent shortened their term. During the past four quarters, more than one-third of HARP borrowers shortened their term.

- The average interest rate reduction in the first quarter was about 1.2 percentage points -- a reduction of about 24 percent. On a $200,000 loan, that translates into saving about $2,500 in interest during the next 12 months. Homeowners who refinanced through HARP benefited from an average rate reduction of 1.8 percentage points and will save an average of $3,500 in interest during the first 12 months or about $290 monthly.

- About 73 percent of those who refinanced their first-lien home mortgage maintained about the same loan amount or lowered their principal balance by paying in additional money at the closing table, about the same as last quarter.

- More than 95 percent of refinancing borrowers chose a fixed-rate loan. Fixed-rate loans were preferred regardless of what the original loan product had been. For example, 76 percent of borrowers who had a hybrid ARM refinanced into a fixed-rate loan during the first quarter. In contrast, only 3 percent of borrowers who had a fixed-rate loan chose an ARM.

- For all other (non-HARP) refinances during the fourth quarter, the median property value was up 5 percent between the dates of placement of the old loan and the new refinance loan. The prior loan had a median age of 5.6 years down from 6.8 years in the fourth quarter of 2014.

Quotes

Attributed to Len Kiefer, Freddie Mac deputy chief economist:

"Many homeowners took advantage of low mortgage rates by refinancing in the first quarter of 2015. Relatively younger loans refinanced as the median age of a refinanced loan declined to 5.6 years, down from 6.8 years in the prior quarter. Refinance borrowers are primarily looking to reduce payments and pay down principal faster. We estimate that borrowers who refinanced in the first quarter will save on net more than $1.4 billion in interest payments over the first 12 months of their new loan. Nearly a third of borrowers who refinanced shortened their loan term."

About the Quarterly Refinance Report

These estimates come from a sample of properties on which Freddie Mac has funded two successive conventional, first-mortgage loans, and the latest loan is for refinance rather than for purchase. The analysis does not track the use of funds made available from these refinances. The analysis also does not track loans paid off in entirety, with no new loan placed. Some loan products, such as 1-year ARMs and balloons, are based on a small number of transactions.

With the report for the first quarter of 2013, the calculation of the principal balance at payoff of the previous loan has been modified. Previously, the payoff balance was calculated as the amount due based on the loan's amortization schedule, and "cash-in" was defined as a new loan amount that was less than the scheduled amortization amount. Data for 1994 to current have been recalculated using the actual payoff amount of the old loan, with an allowance for rounding down the principal at refinance; thus, from 1994 to present, "cash-in" is defined as a new loan amount that is at least $1,000 less than the payoff principal balance of the old loan. Data are presented under both methods for 1994 for comparison purposes.

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is one of the largest sources of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.