MCLEAN, VA--(Marketwired - Sep 20, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Outlook for September showing that housing remains a bright spot for the U.S. economy. Mortgage originations are expected to surge in the third quarter, and our forecast for the best year in home sales since 2006 looks increasingly on the mark.

MCLEAN, VA--(Marketwired - Sep 20, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Outlook for September showing that housing remains a bright spot for the U.S. economy. Mortgage originations are expected to surge in the third quarter, and our forecast for the best year in home sales since 2006 looks increasingly on the mark.

Outlook Highlights

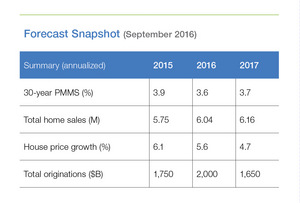

- Expecting the 30-year fixed rate mortgage to average 3.6 percent in 2016, the lowest annual average in over 40 years. The current record low annual average occurred in 2012 at 3.66 percent.

- Showing that falling mortgage rates from 4 percent at the end of 2015 to about 3.5 percent in the third quarter of 2016 have more than offset the rise in house prices in most markets, helping to preserve homebuyer affordability.

- Revising up our forecast of home price appreciation to 5.6 percent and 4.7 percent in 2016 and 2017, respectively. This is up from last month's forecast of 5.3 percent for 2016 and 4.0 percent for 2017.

- Showing cash-out refinance activity on the rise in the second quarter, with an estimated $13.3 billion net dollars of home equity converted to cash during refinancing. This is up from $11.4 billion in the first quarter of 2016 but substantially less than the peak cash-out refinance volume of $84.0 billion during the second quarter of 2006.

- Remaining on track for mortgage originations to reach $2 trillion in 2016, the highest total since 2012.

Quote: Attributed to Sean Becketti, Chief Economist, Freddie Mac.

"The housing market remains a bright spot for the U.S. economy, with solid job gains and low mortgage interest rates sustaining the economy's momentum in September. In most markets, low mortgage rates have more than offset the rise in house prices, preserving homebuyer affordability for the typical household. Homeowners are also taking advantage of low rates and house price appreciation that is increasing their home equity. The share of cash-out refinances grew to 41 percent in the second quarter of 2016, compared to 38 percent in the first quarter and 15 to 20 percent during the housing crisis."

"Mortgage originations are expected to surge in the third quarter, reflecting the impact of Brexit in recent mortgage activity. We continue to believe that originations will reach $2 trillion this year, the highest since 2012."

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is the largest source of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.