MCLEAN, VA--(Marketwired - Mar 31, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Outlook for March forecasting that total home sales, housing starts, and house prices will reach their highest levels since 2006 despite inventory and affordability challenges.

MCLEAN, VA--(Marketwired - Mar 31, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Outlook for March forecasting that total home sales, housing starts, and house prices will reach their highest levels since 2006 despite inventory and affordability challenges.

Outlook Highlights

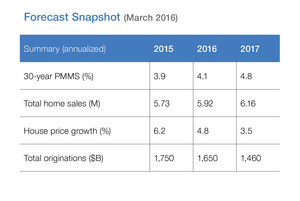

- Expect the 30-year mortgage rate to remain very attractive throughout the spring homebuying season, staying below 4 percent until the second half of the year.

- Forecasting that combined multifamily and single-family housing starts will increase 200,000 units to 1.3 million in 2016.

- In 2015, house prices increased about 6 percent on a year-over-year basis. Expect house prices to continue to rise, but at a moderating pace, with annual house price appreciation slowing to 4.8 percent in 2016.

- Increased the full-year 2016 total mortgage originations forecast by $70 billion to $1,650 trillion due to higher expected house prices.

Quote: Attributed to Sean Becketti, Chief Economist, Freddie Mac.

"Housing markets are poised for their best year in a decade. In our latest forecast, total home sales, housing starts, and house prices will reach their highest levels since 2006. Low mortgage rates, robust job growth and a gradual increase in housing supply will help drive housing markets forward. Low levels of inventory for-sale and for-rent and declining housing affordability will be major challenges, but on balance the nation's housing markets should sustain their momentum from 2015 into 2016 and 2017."

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is the largest source of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.