Fun After Fifty

MCLEAN, VA--(Marketwired - Jul 19, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Insight for July with further insights on the perceptions and plans of 55+ homeowners and the impact they'll have on the broader housing market for years to come based on the results from the Freddie Mac 55+ Survey.

MCLEAN, VA--(Marketwired - Jul 19, 2016) - Freddie Mac (OTCQB: FMCC) released today its monthly Insight for July with further insights on the perceptions and plans of 55+ homeowners and the impact they'll have on the broader housing market for years to come based on the results from the Freddie Mac 55+ Survey.

Insight Highlights

- Individuals older than 54 comprise a little over a quarter of the population of the U.S., but they control roughly two-thirds of the equity in single-family homes.

- Today's 65-year-old who bought the "average" house at age 30 has seen the value of that house increase 3.7 times.

- The influence of the 55+ population will last a long time. Today's 65-year-old can expect to live until age 84 on average. In contrast, the life expectancy of the Greatest Generation -- those born between 1900 and 1924 -- was 47 years.

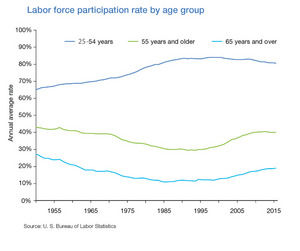

- After bottoming out in the mid-1990s, the labor force participation rate of the 55+ population has been increasing.

- More than a third of 55+ homeowners still have a mortgage, and a majority of those with a mortgage have more than ten years left until their loan is paid off.

Quote: Attributed to Sean Becketti, Chief Economist, Freddie Mac.

"In the conventional wisdom on the housing life cycle, the Millennials should be providing a surge in first-time homebuyers, while older generations should be moving to the next stage of their housing life: Gen Xers should be trading up from a starter home to a larger home. Baby Boomers should be selling their homes to Gen Xers and downsizing, renting, or moving to an age-specific community. And the Silent Generation should be thinking about moving to assisted living or moving in with adult children.

"With the possible exception of Gen X, people are ignoring the conventional wisdom. Millennials are taking longer to marry, start families, and buy their first homes. And the 55+ population are working longer, aging in place, or buying an additional home (or two) rather than winding down. Furthermore, they expect to be an active part of our housing economy for quite a while longer."

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is the largest source of financing for multifamily housing. Additional information is available at FreddieMac.com, Twitter @FreddieMac and Freddie Mac's blog FreddieMac.com/blog.

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.