Over 5 Million Expect to Rent Next Home by 2020

MCLEAN, VA--(Marketwired - Jun 28, 2016) - Freddie Mac (OTCQB: FMCC) -- Baby Boomers and others aged 55 or older, including several million current homeowners, are poised to move to rental units based on estimates from the first Freddie Mac 55+ Survey of housing plans and perceptions of people born before 1961.

MCLEAN, VA--(Marketwired - Jun 28, 2016) - Freddie Mac (OTCQB: FMCC) -- Baby Boomers and others aged 55 or older, including several million current homeowners, are poised to move to rental units based on estimates from the first Freddie Mac 55+ Survey of housing plans and perceptions of people born before 1961.

The Freddie Mac 55+ Survey shows an estimated 6 million homeowners and nearly as many renters prefer to move again and rent at some point. Of those that expect to move again, over 5 million indicate they are likely to rent by 2020.

Majorities of 55+ renters (79 percent) and homeowners (83 percent) who expect to rent their next home predict it will cost the same or less than their current one, according to the Freddie Mac 55+ Survey.

"When a population this large expects to move into less expensive rental housing, we have to expect it will create significant new pressure on both the supply and cost of existing affordable rental housing," said David Brickman, executive vice president, Freddie Mac Multifamily.

Other findings from the Freddie Mac 55+ Survey found just over half of renters (51 percent) prefer renting over owning. This is especially true among existing multifamily renters (60 percent). The survey also underscores the need for additional affordable rental housing. Specifically, 47 percent of 55+ renters say they struggle from payday to payday, while 13 percent admitted they sometimes could not afford basics until their next paycheck.

Conducted by GfK on behalf of Freddie Mac, the Freddie Mac 55+ Survey is based on responses from nearly 6,000 homeowners and renters. The Survey explored other questions related to the housing preferences, retirement plans and financial concerns of Baby Boomers and those older who rent or own.

55+ Renters' Future Housing Preferences and Predictions

When asked to predict their future housing situation, significant percentages of 55+ renters say:

They plan to rent versus buying their next home. Among those 55+ renters who plan to move again, 71 percent of respondents plan to rent their next home. For many this may be a renter-by-choice decision as 38 percent say they have enough extra money to go beyond each payday including for savings. Further, more than half (59 percent) think it makes financial sense for people their age to be renters. This view is held by 67 percent of multifamily renters.

Their top attractions are affordability, amenities. Among the top "very important" factors influencing their next move, respondents picked affordability (60 percent), amenities needed for retirement (47 percent), living in a community where they are no longer responsible for caring for the property (44 percent) and being in a walkable community (43 percent).

They don't want to move far. Among those who plan to move again, 55+ renters would like to relocate to a different neighborhood in the same city (31 percent) or a different property in the same neighborhood (23 percent) compared to those who would like to move to a different city in the same state (18 percent) or move to a different state (24 percent).

They want family near (or in) their next home. When asked to predict their retirement housing situation nearly six out of ten 55+ renters prefer to either move closer to their families or in with them. Hispanic single-family renters (44 percent) were most likely to predict they will move closer to family, while multifamily Asian-American renters (40 percent) were most likely to predict they will move in with their children.

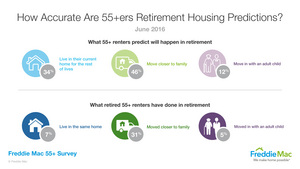

The Freddie Mac 55+ Survey also found significant differences between the housing predictions of 55+ers who haven't retired and the housing choices retirees actually made. For example:

- Thirty-four percent of renters predict they will live in their current home for the rest of their lives, but only 7 percent of retired renters say they currently live in the same home.

- Forty-six percent of renters predict they will move closer to family in retirement, but of those already retired only 31 percent have done so.

- While 12 percent of renters predict they will move in with an adult child, less than half that amount (5 percent) of those already retired are living with one of their adult children.

Methodology

GfK conducted an online survey on behalf of Freddie Mac using the GfK KnowledgePanel® from February 10-23, 2016. A total of 5,914 interviews were completed online, including oversamples of African-Americans, Hispanics and Asians, obtained through additional opt-in sample. Interviews were conducted in both English and Spanish. GfK's KnowledgePanel® is the only large-scale online panel based on a representative random sample of the U.S. population. The margin of sampling error was +/- 1.27 percentage points for the full sample. Sampling error is higher for subgroups. See the report for the full methodology.

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation's residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four homebuyers and is the largest source of financing for multifamily housing. www.FreddieMac.com. Twitter: @FreddieMac

The financial and other information contained in the documents that may be accessed on this page speaks only as of the date of those documents. The information could be out of date and no longer accurate. Freddie Mac does not undertake an obligation, and disclaims any duty, to update any of the information in those documents. Freddie Mac's future performance, including financial performance, is subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect the company's future results are discussed more fully in our reports filed with the SEC.